Well, yes. A CPA course (Certified Public Accountant) qualification will certainly help you count and mint money but for others!

You will be taking care of the finances of the organization you are working with. That’s all. It is a well-paid but highly competitive job in a fast-paced environment and tremendous pressure.

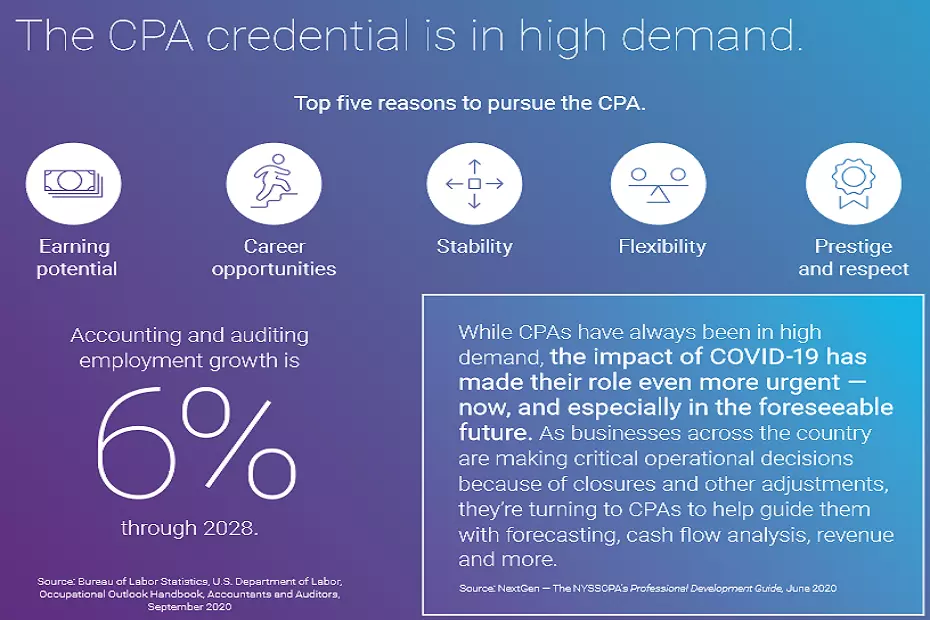

With the emergence of new businesses and the expansion of the distribution of resources, there is an urgent need for professional accountants who can act as financial advisors and keep track of all cash resources. To meet this demand, certified public accountants have been in high demand ever since. If you are looking forward to a lucrative career in business and accounting and want to be a globally recognized professional, then completing a CPA course is the first step toward achieving your dream.

Come along to know more…

Topics covered

What all is covered in this post?

To make it easier for you, we have created a quick guide to everything you need to know about the CPA course.

What is CPA Course?

The CPA credential is the only licensing qualification in accounting & auditing in the US and is accepted globally. CPAs are in demand and needed everywhere – at public accounting firms (including Big 4) and at every company whether big or small (including MNCs).

There are 55 jurisdictions (50 states & 5 U.S. territories) with independent Boards of Accountancy. You must pass all four sections of the CPA Exam within 18 months. It is a computer-based test. You cannot take it on paper.

It’s Indian counterpart

The Indian CA qualification isn’t recognized in the USA. Although there is CPA and chartered accountant reciprocity between the US and some countries, no agreements currently exist between the US and India.

Therefore, an Indian CA wishing to work as a professional certified public accountant in the US must apply for the CPA course too.

What is CPA Course? – This is the only accepted US qualification for practising as a professional certified public accountant.

CPA course full form – Certified Public Accountant

CPA Course Details

CPA is a qualification accepted in the US whereas, India only has a handful of companies working under US accounting standards, hence prospects here in our country are at best moderately bleak with a CPA qualification.

The median salary for a CPA in the U.S. is $60,000+ and in India, approximately, Rs 8–10 lakh a year and the median salary for a CA in India is. 6.5 to 7.8 lakh a year.

*Figures are approximate & indicative only. Please use discretion.

If you plan to only work in the United States, you will only need the CPA without the CA. If you plan to only work for non-US companies in India or other companies that are not traded on US markets, you may only need the Indian CA.

CPA Course Highlights

| Course | CPA |

| Course Type | Certification |

| CPA Full form | Certified Public Accountant |

| Duration | 18 months |

| Eligibility | Bachelor’s degree |

| Employment opportunities | Auditing Clerk, Accounts Receivable Clerk, Accounting Assistant, Accounts Payable Clerk. |

| Similar Course | CFA |

| Starting salary offered | 8 – 10 Lakhs Per Annum |

Also Read: CPA Salary in USA

CPA course eligibility

If you are planning to take the CPA course, you must meet the qualification criteria set by the Institute of Chartered Accountants. Criminal requirements:

- Candidate should have B. Com/M. Com major in Accountancy OR

- Candidate should have BBM / BBA major in Finance and Accounting OR

- He/she should have obtained an MBA in Finance OR

- Candidates who have passed CA Intermediate or CMA Intermediate can also pursue this course

And it is also assumed that one should have a thorough knowledge of basic computer skills and good knowledge of accounting software to complete the CPA exams and practicals (such as Tally and MS-Office).

US CPA course eligibility for Indian students

The CPA exams are administered by the AICPA, the world’s largest public accounting organization. The AICPA offers membership to all applicants who pass all 4 CPA exams. However, the CPA license is issued by the boards of public accountants of the 55 US states that are members of the NASBA. Each state board has different eligibility criteria that an applicant must meet in order to pass the US CPA exams.

Here are the requirements for a CPA course in the US:

- Master’s degree in any stream of commerce, accounting or finance

- An applicant needs 120 credits to pass the US CPA exams and 150 credits to obtain a CPA license

- One year of university education in India is considered to be equivalent to 30 credits of education in the US

- In some cases, first division graduates of three-year degrees from NAAC-A accredited universities in India are also eligible to take the US CPA exams.

CPA course colleges & institutes in India

Following are the institutes that provide CPA coaching in India:

- Aditya Jain Classes

- Arivupro Academy

- Concorde Academics

- Crosswalk

- Edudelphi

- EduPristine

- Horizon Global Education

- Miles Education

- Satish Mangal Classes

- Simandhar Education

- VG Learning Destination

- Zell Education

Note: Students are advised to do their own research before enrolling in any institutes.

CPA course fees

The CPA course fees all over India is the same.

- Auditing and Attestation (AUD): $356.55

- Business Environment and Concepts (BEC): $356.55

- Financial Accounting and Reporting (FAR): $356.55

- Regulation (REG): $356.55

US CPA course fees

The total cost of a US CPA course with the exam for an Indian student is often divided into three parts:

- CPA training fee is around INR 1,05,000/- to INR 1,20,000/-.

- The evaluation fee is around INR 17,000/- to INR 22,000/-.

- The exam fee plus international testing fees is around INR 2,00,000.

The average cost of a full US CPA course in India is INR 3.5 to 3.6 lakhs.

The CPA exam fee is $1,000 and the international test fee is $1,500. Also, $225 per assessment makes the total CPA exam fee in India around 2,00,000/- to 2,50,000/- excluding tuition fees.

Previously, students had to bear additional expenses for travel as well, as they had to appear for exams in the US. But now the scenario is different. According to the latest update by NASBA & AICPA, the CPA exam will now be held in India itself.

CPA course duration

The CPA exam must be taken within 12-18 months of the date of registration. Registration for the CPA course is open throughout the year; you can register at any time. You also need to study for at least 3 months before you decide to schedule any of the exams. Because exams are on-demand and can be scheduled at any time, students decide how they want to sit and take the exams.

CPA course duration after Bcom

Generally, most Indian B. Com graduates are eligible to take the CPA exam. Each year of university education in India is equivalent to 30-semester credits of US education, which is 90 credits at the end of 3 years.

CPA course syllabus

The CPA is a 4-hour exam that consists of four parts. Applicants must complete all sections within the 18-month testing window. They can choose any section in any order during one open testing window. Candidates can take any number of tests in the same window. However, there is one catch. Candidates cannot take the same section twice in the same testing window. And if they fail one part of the exam, they won’t be able to retake that exam until the next testing window opens for them. We have listed these sections and possible areas for questions below:

Auditing and Attestation (AUD)

- Conclusions and Reporting

- Ethics, General Principles, and Professional Responsibilities

- Performing Further Procedures and Obtaining Evidence

- Risk assessment, Response Development

Business Environment and Concepts (BEC)

- Corporate Governance

- Economic Concepts and Analysis

- Financial Management

- Information Technology

- Operations Management

Financial Accounting and Reporting (FAR)

- Financial Accounting

- Financial Statement Accounts

- Local and State Governments

- Standard-Setting, Conceptual Framework, and Financial Reporting

- Transactions

Regulation (REG)

- Business Law

- Entity Federal Taxation

- Individual Federal Taxation

- Professional Responsibilities, Ethics, and Federal Tax Procedures

- Property Transaction Federal Taxation

Conclusion

So, you want to earn your CPA? Here you have all resources to make a move on.

Still unsure? At iDreamCareer, with the help of our Career Counselling and Guidance Services and educational counsellors, we try to help derailed minds from 9th class, 10th class, class 11, class 12 with an aim to select suitable career choices.

Talk to our study abroad experts who have 20+ years of experience to know yourself in and out! We have helped several brilliant but confused minds with the aim to select their most-suited career choices. Hear the success story of Aayush who got an offer from the top 3 universities and is now studying at a University in Ottawa in Canada after getting career guidance from our industry experts!

Also, read;

- How to become Accountant in India

- Career Options After 12th Commerce

- Best Courses after 12th Commerce

- Career as a Chartered Accountant

- Career Options for Women

- CPA Exam (official portal)

- CMA Courses

- NASBA (official portal)

- CA Course: The #No.1 Full Stack Guide to Chartered Accountancy

- CA: All you need to Know

- Career in Finance

- Public Universities in USA

FAQs

At least a diploma or equivalent degree. 150 academic hours of college study to obtain a CPA license. 1-2 years of experience in any CPA.

Here are the 5 best CPA prep courses: Best Overall: Becker CPA Review; Runner-Up, Best Overall: UWorld Roger CPA Review; Best Artificial Intelligence Tools: Surgent CPA Review; Best Value: Gleim CPA Review; Best Price: Ninja CPA Review, etc.

The CPA exam must be taken within 12-18 months of the date of registration. Registration for the CPA course is open throughout the year; you can register at any time. You also need to study for at least 3 months before you decide to schedule any of the exams.

Applying for the CPA exam is a process in itself, and you want to make sure that every step is followed and that you meet all of the eligibility requirements. Before you apply for the CPA exam, make sure you’ve met all the CPA exam requirements in your chosen state. Each state has its own age, education, and residency requirements for eligibility to take the exam. Make sure you have the right documents for your CPA exam application.

The key question that arises is – does CPA benefit my career or CA? There is no clear winner because both qualifications will help develop your technical, and accounting skills. read on, and business management skills.

The CPA exam is challenging for the following reasons: It covers a wide range of subjects and topics that test candidates at different levels. It assesses all candidates in the form of questions that give them real-world experience.

Anushree Rastogi is a Senior Content Writer at iDreamCareer, bringing over 5 years of expertise to the field of career counseling. She has done a PGDM in Marketing and Finance and possesses a unique blend of skills that allows her to craft engaging and informative content. She is passionate about helping individuals navigate their career paths and has dedicated her career to providing valuable insights through her content. Her commitment to excellence and keen understanding of the career landscape make her a trusted guide for those seeking professional direction. With a flair for clear and engaging writing, Anushree is on a mission to empower others to make informed and fulfilling career choices.