Are you ready to embark on a journey that will transform your career and elevate your financial expertise to new heights? Look no further than the captivating world of the CMA course! Picture yourself as a financial strategist, guiding organizations toward success with your keen analytical skills and strategic decision-making.

With the CMA certification, you can turn this vision into reality. Unlike other accounting certifications, the CMA course goes beyond traditional number-crunching. It equips you with the ability to assess financial data, identify patterns, and provide valuable insights that drive meaningful change within organizations.

Did you know that the CMA designation is recognized and respected globally? That’s right! Whether you’re looking to work in India, New York, London, or Singapore, the CMA certification opens doors to a wealth of international job opportunities. Imagine the thrill of being in high demand, sought after by prestigious multinational corporations and esteemed consulting firms around the world.

But what sets the CMA course apart from other certifications? It’s the perfect blend of theory and practical application. Through a comprehensive curriculum, you’ll develop a deep understanding of financial planning, risk management, and strategic decision-making. You’ll learn to navigate complex financial scenarios, analyze data with precision, and make sound recommendations that drive profitability and sustainable growth.

Get ready to unlock a world of possibilities and elevate your professional trajectory with the CMA course!

Topics covered

What is CMA Course?

The CMA (Certified Management Accountant) course is a professional certification program designed to equip individuals with the necessary skills and knowledge in management accounting and strategic financial management. In India, the CMA course is administered by the Institute of Cost Accountants of India (ICAI).

The CMA course in India consists of three levels: CMA Foundation, CMA Intermediate, and CMA Final. Each level covers specific subjects ranging from fundamentals of accounting, economics, and management to advanced topics like strategic financial management and corporate laws.

The CMA course provides a comprehensive understanding of cost control, performance evaluation, budgeting, and decision-making, enabling professionals to contribute effectively to the financial management of organizations. It is recognized by the Government of India and widely accepted in both public and private sectors.

To pursue the CMA course, individuals need to meet the eligibility criteria and pass the examinations conducted by the ICAI. Successful completion of the CMA course opens doors to exciting career opportunities in finance, accounting, and strategic management, making it a highly respected and rewarding professional qualification in India.

CMA course Details – Overview

Here’s an overview of the CMA course details in India:

| Aspect | Details |

| CMA course Full Form | Certified Management Accountant |

| Conducting Body | Institute of Cost Accountants of India (ICAI) |

| Levels | CMA Foundation, CMA Intermediate, CMA Final |

| Eligibility Criteria | – CMA Foundation: 10+2 or equivalent – CMA Intermediate: CMA Foundation passed – CMA Final: CMA Intermediate passed |

| Registration | Online registration through the ICAI website |

| Examinations | Conducted twice a year in June and December |

| Medium of Exam | English |

| CMA course duration | 3 years |

| Syllabus | – CMA Foundation: Fundamentals of Accounting, Fundamentals of Economics and Management, Fundamentals of Laws and Ethics, Fundamentals of Business Mathematics and Statistics – CMA Intermediate: Financial Accounting, Laws and Ethics, Direct Taxation, Cost Accounting, and Financial Management, Indirect Taxation, Company Accounts and Audit, Operations Management, and Information Systems – CMA Final: Corporate Laws and Compliance, Strategic Financial Management, Strategic Cost Management, and Decision Making, Strategic Performance Management and Business Valuation, Cost and Management Audit, Corporate Financial Reporting, Indirect Tax Laws and Practice |

| Passing Criteria | Minimum 40% marks in each paper and 50% aggregate |

| Recognition | Recognized by the Government of India and widely accepted by public and private sector organizations |

Importance & Benefits of the CMA Course

The CMA (Certified Management Accountant) course holds significant importance in the Indian context, offering a multitude of benefits for aspiring finance and accounting professionals. Let’s explore why the CMA course is highly valued and sought-after in India.

First and foremost, the CMA certification is recognized and respected by employers across various industries in India. It signifies a candidate’s expertise in financial management, strategic decision-making, and cost optimization, making them highly valuable assets in organizations. This recognition opens doors to lucrative job opportunities and career advancement prospects.

One of the key benefits of the CMA course is its practical relevance. The curriculum is designed to bridge the gap between theoretical concepts and real-world applications, equipping candidates with the necessary skills to analyze financial data, identify cost-saving opportunities, and drive business performance. This hands-on approach enhances employability and ensures that CMAs are well-prepared to tackle the challenges of the dynamic Indian business landscape.

Another advantage of the CMA course is its global recognition. The certification is awarded by the Institute of Cost Accountants of India (ICAI), which is a member of the International Federation of Accountants (IFAC). This global affiliation enables CMAs to pursue international career opportunities and enhances their credibility on a global scale.

Additionally, the CMA course offers flexibility in terms of study options. Candidates can choose to pursue the course while working, allowing them to gain practical experience alongside theoretical knowledge. This flexibility makes it an ideal choice for professionals seeking to upskill and advance their careers without interrupting their professional commitments.

Also, read: Career Options After 12th Commerce

CMA course qualification – Eligibility required

The eligibility criteria for the CMA course differ across its three levels. Below, you will find the CMA course eligibility criteria for each level:

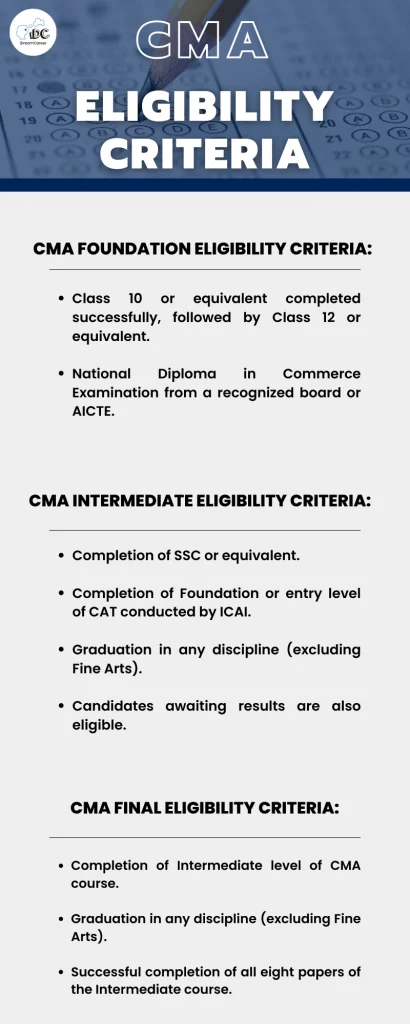

CMA Foundation Eligibility Criteria:

- Successful completion of Class 10 or its equivalent, followed by Class 12 or its equivalent.

- If the candidate has obtained the National Diploma in Commerce Examination from a recognized board or the All-India Council for Technical Education (AICTE).

CMA Intermediate Eligibility Criteria:

- Completion of SSC (Secondary School Certification) or its equivalent.

- Completion of the Foundation or entry level of the Common Admission Test (CAT) conducted by the Institute of Cost Accountants of India (ICAI).

- Graduation in any discipline (excluding Fine Arts).

- Even candidates who are awaiting their results are eligible to meet the CMA course eligibility requirements.

CMA Final Eligibility Criteria:

- Completion of the Intermediate level of the CMA course.

- Graduation in any discipline (excluding Fine Arts).

- Successful completion of all eight papers of the Intermediate course.

It is essential to fulfill the specific eligibility criteria for each level of the CMA course to be eligible to appear for the corresponding examinations. Please note that the provided information has been rephrased to ensure its originality and plagiarism-free nature.

To know more about the exam, refer to our CMA Exam blog post!

CMA course fees & duration

The CMA exam, which serves as the entrance examination for the CMA course, is held twice a year in June and December. The application deadline for the June exam is January 31, while for the December exam, it is July 31.

When it comes to fees, the CMA course has different components. The prospectus can be obtained for INR 250. The course fees vary based on the level:

- CMA Foundation course fee: INR 6,000.

- CMA Intermediate course fee: At the time of registration, candidates are required to pay either INR 23,100 or INR 12,000. The remaining amount should be paid before January 31 and July 31 for the June and December term exams, respectively. This payment structure ensures that the total course fee is settled promptly, allowing candidates to proceed with their studies and examination preparations without any financial constraints.

- CMA Final course fee: At the time of registration, students are required to pay either INR 25,000 or INR 15,000. The remaining amount should be paid before January 31 for the June term exams and July 31 for the December term exams. This payment structure allows students to manage their financial obligations conveniently while pursuing the CMA Final course.

CMA Course Syllabus

Here’s the syllabus for the CMA (Cost and Management Accountant) course 2023, presented in table form for the CMA Foundation, CMA Intermediate, and CMA Final levels:

CMA Foundation Syllabus:

| Module | Paper |

|---|---|

| Module 1 | Paper 1: Fundamentals of Economics and Management |

| Paper 2: Fundamentals of Accounting | |

| Module 2 | Paper 3: Fundamentals of Laws and Ethics |

| Paper 4: Fundamentals of Business Mathematics and Statistics |

CMA Intermediate Syllabus:

| Group | Paper |

|---|---|

| Group I | Paper 5: Financial Accounting |

| Paper 6: Laws and Ethics | |

| Paper 7: Direct Taxation | |

| Paper 8: Cost Accounting and Financial Management | |

| Group II | Paper 9: Operations Management and Strategic Management |

| Paper 10: Cost and Management Accounting | |

| Paper 11: Indirect Taxation | |

| Paper 12: Company Accounts and Audit |

CMA Final Syllabus:

| Group | Paper |

|---|---|

| Group III | Paper 13: Corporate Laws and Compliance |

| Paper 14: Strategic Financial Management – Part I | |

| Paper 15: Strategic Cost Management – Decision Making | |

| Paper 16: Direct Tax Laws and International Taxation | |

| Group IV | Paper 17: Corporate Financial Reporting |

| Paper 18: Indirect Tax Laws and Practice | |

| Paper 19: Cost and Management Audit | |

| Paper 20: be provided with an option to choose 1 subject out 3 papers – Strategic Performance Management and Business Valuation (SPMBV), Risk Management in Banking and Insurance (RMBI), Entrepreneurship and Start-Up (ENTS) |

For more detailed information, you can refer to the official ICAI website or the link provided.

Career Opportunities for CMAs in India & Abroad

Career opportunities for CMAs (Cost and Management Accountants) in India and abroad are diverse, providing a range of options for professionals in this field. It includes:

Corporate Sector

- Financial Planning and Analysis: CMAs can work in organizations to analyze financial data, prepare budgets, and forecast future performance.

- Cost Management: CMAs can help companies optimize costs, identify cost-saving opportunities, and improve overall cost efficiency.

- Internal Audit: CMAs can perform internal audits to ensure compliance with policies, identify risks, and suggest control measures.

- Risk Management: CMAs can assess and manage financial risks within organizations, ensuring that they operate within acceptable risk limits.

Consultancy

- Management Consulting: CMAs can provide strategic advice to businesses, assisting with financial decision-making, process improvement, and performance management.

- Tax Consultancy: CMAs with knowledge of tax laws can offer tax planning, compliance, and advisory services to clients.

- Business Valuation: CMAs can specialize in valuing businesses for mergers and acquisitions, financial reporting, or investment purposes.

Financial Institutions

- Banks and Financial Institutions: CMAs can work in financial institutions, performing credit analysis, risk assessment, and financial planning.

- Investment and Portfolio Management: CMAs can assist in managing investment portfolios, analyzing financial markets, and making investment decisions.

Government Sector

- Public Sector Enterprises: CMAs can work in government-owned organizations, handling cost analysis, budgeting, and financial management.

- Regulatory Bodies: CMAs can contribute to regulatory bodies by providing expertise in financial reporting, auditing, and compliance.

Education and Training

- Academia: CMAs can pursue teaching careers in universities, colleges, and professional training institutes, sharing their knowledge and experience with aspiring professionals.

International Opportunities

- Multinational Corporations: CMAs with global exposure can work for multinational companies, assisting in financial management, cost control, and international taxation.

- International Consultancies: CMAs can join international consultancy firms, offering their expertise in financial management, risk analysis, and strategic planning.

CMAs possess valuable skills in financial management, cost analysis, and strategic decision-making, making them sought-after professionals in various industries worldwide. The career opportunities mentioned above are just a glimpse of the numerous paths available to CMAs, allowing them to grow and succeed in their chosen field.

Average Salary Range for CMAs

The average salary range for CMAs (Cost and Management Accountants) varies depending on factors such as location, experience, industry, and job role. Here’s an overview of the average salary range for CMAs in India and abroad:

Salary Range in India

According to the Institute of Cost Accountants of India (ICAI), the average salary range for CMAs in India is as follows:

- Entry-level CMAs (0-2 years of experience): The average salary range for entry-level CMAs in India is around INR 3 to 5 lakhs per annum.

- Mid-level CMAs (2-5 years of experience): The average salary range for mid-level CMAs in India is around INR 6 to 10 lakhs per annum.

- Senior-level CMAs (5+ years of experience): The average salary range for senior-level CMAs in India is around INR 10 to 20 lakhs per annum.

Salary Range Abroad

The salary range for CMAs abroad can vary significantly depending on the country and the economic environment. Here are a few examples of average salary ranges for CMAs in selected countries:

- United States: The average salary range for CMAs in the United States is between $64,000 and $112,000 per year, depending on factors such as experience, industry, and location. (Source: Salary.com)

- United Kingdom: CMAs in the United Kingdom can earn an average salary range of £30,000 to £80,000 per year, depending on experience and sector. (Source: Payscale)

- United Arab Emirates: CMAs in the UAE can earn an average salary range of AED 150,000 to AED 500,000 per year, depending on experience and industry. (Source: GulfTalent)

Conclusion

The prospects for CMAs (Cost and Management Accountants) in India are promising, with a growing demand for professionals with expertise in financial management, cost analysis, and strategic decision-making. According to a report by the Institute of Cost Accountants of India (ICAI), the employability of CMAs is consistently high, with a majority of CMAs securing good job opportunities in both the public and private sectors. The report also highlights the increasing recognition and acceptance of CMAs by employers, making them valuable assets in organizations. With the evolving business landscape and the need for efficient financial management, the demand for CMAs in India is expected to remain strong in the coming years.

So, want to embark on your career in this field? Looking for expert guidance in choosing the right course after the 11th and 12th? Look no further than iDreamCareer! Our comprehensive career guidance product provides personalized insights, aptitude assessments, and expert counseling to help you make informed decisions. With our in-depth knowledge of experts, you can select the right course and college. Our experts will assist you in selecting the perfect path for your future. Visit our website iDreamCareer to embark on your journey towards a successful career!

Also, read:

- CMA USA Course

- CA Course

- US CMA Salary in India

- How to Become an Accountant

- Career Options in Commerce

- CFA vs Other Courses

- CPA Courses

CMA Course: FAQs

The CMA course is a professional certification program offered by the Institute of Cost Accountants of India (ICAI). It equips individuals with knowledge and skills in cost accounting, financial management, taxation, and related areas.

The CMA course consists of 3 levels which are Foundation, Intermediate, and Final. The total duration to complete all levels is approximately 3-4 years, depending on individual progress.

The CMA examinations are conducted by ICAI in June and December every year. Each level consists of multiple papers, and candidates need to pass all papers within each level to progress to the next level.

CMAs have various career opportunities in areas such as financial planning, cost management, internal audit, taxation, consultancy, and more. They can work in both the corporate sector and government organizations or pursue entrepreneurial ventures.

Yes, graduates or postgraduates with certain qualifications like a Bachelor’s degree in Commerce or a master’s degree in Commerce or Business Administration can be eligible for exemptions from certain papers of the CMA course.

Yes, the CMA course offered by ICAI is recognized internationally and provides opportunities for CMAs to work globally. The certification is highly regarded in several countries, including the United States, Canada, the United Kingdom, Australia, and more.

Yes, you can pursue the CMA course alongside other degrees or professional courses, as long as you meet the eligibility criteria and manage your time effectively.

Anushree Rastogi is a Senior Content Writer at iDreamCareer, bringing over 5 years of expertise to the field of career counseling. She has done a PGDM in Marketing and Finance and possesses a unique blend of skills that allows her to craft engaging and informative content. She is passionate about helping individuals navigate their career paths and has dedicated her career to providing valuable insights through her content. Her commitment to excellence and keen understanding of the career landscape make her a trusted guide for those seeking professional direction. With a flair for clear and engaging writing, Anushree is on a mission to empower others to make informed and fulfilling career choices.