Studying abroad at a top university is every student’s dream. If given an opportunity, students will pursue their higher education at the university of their dreams abroad and will pass with distinction. But having funds for studying abroad can cost an arm and a leg for a student. Almost everybody looks for an education loan for abroad studies.

Students may need to do penny-pinching or take scholarships/fellowships to support their studies. But what if you won’t be able to save money? Who will pay for your education abroad? If you worry about this, don’t anymore.

Here is the solution.

In this article, we will talk about eligibility criteria for applying for education loans, a procedure for getting student loans for studying abroad, a procedure for getting education loans for abroad studies without collateral, and much more!

Topics covered

Why consider education loans for abroad studies?

The expense of pursuing higher education from abroad could be huge which is why taking education loans is a viable option for students who are planning to pursue higher education abroad. In addition to providing financial assistance, it helps close the gap between available funds and the required amount.

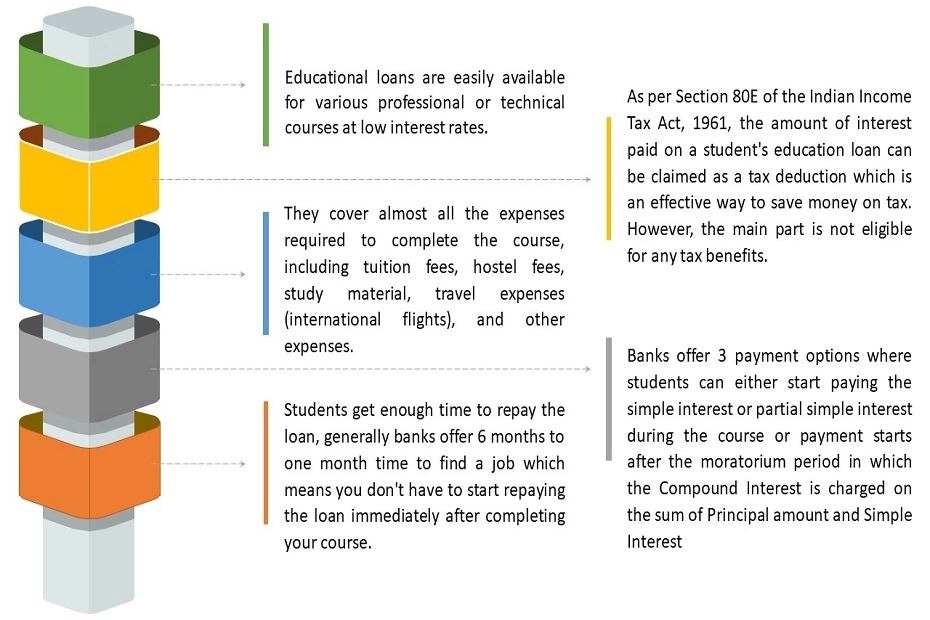

Following are some of the benefits of taking an education loan for abroad studies:

Types of student loans for studying abroad

- Secured loans for abroad studies: It is a type of loan where the borrower promises some of his or her assets as collateral. If a person borrows a secure loan, he or she will have to mortgage property to a bank or financial institution.

NOTE: Agricultural land cannot be mortgaged by the loan borrower.

- Unsecured loans for abroad studies: Unsecured loans are loans that are not secured against the assets of the borrower. These loans can be easily availed from financial institutions (Private banks/NBFCS or international lenders) under many different methods or marketing packages. There are several conditions that must be met to obtain an unsecured loan.

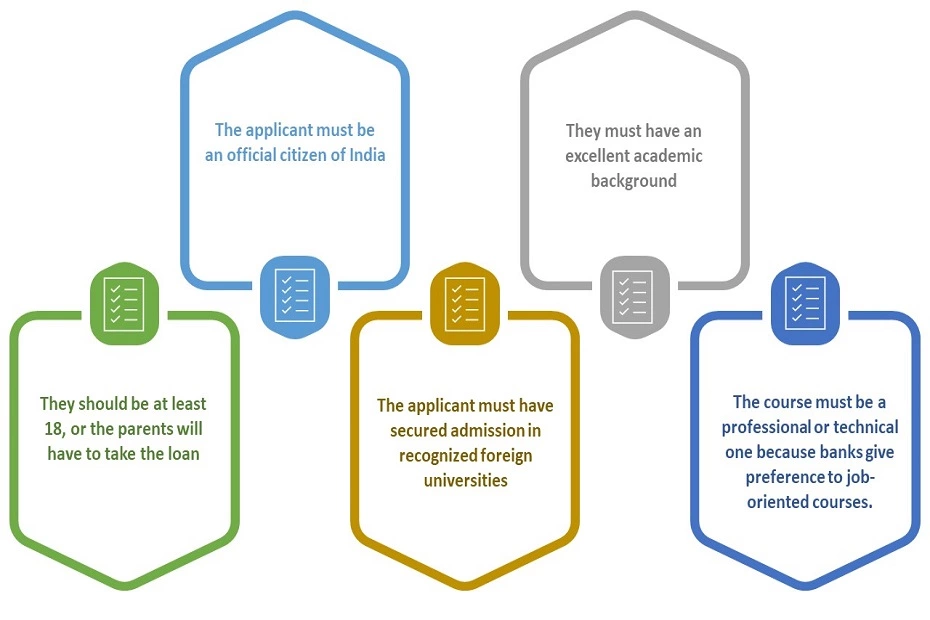

Eligibility criteria for education loan for abroad studies

First and foremost, it is important to assess whether you are eligible to apply for an education loan or not. Listed below are some of the general terms and conditions that are usually followed by any bank while providing an education loan. Please note that individual banks may have their eligibility guidelines to be followed when applying to that bank.

Documents required for applying for education loan for abroad studies

| Document Type | Applicant And Co-applicant |

| Date Of Birth | Birth Certificate, Passport, Voter card with DOB, College Passing Certificate, PAN Card, Driving license, Aadhaar Card |

| Residence Proof (if owned) | Electricity Bill, Municipal Tax Receipt, Share Certificate or Title Deed (with Flat No) |

| Residence Proof (for a rented property | Registered Rent agreement (with utility bill), Landline phone bill, Post Paid Mobile Bill, Bank statement, Passport, Driving License, Voter ID, and Aadhaar card |

| Photograph | Passport size photographs |

| Photo ID | Photo ID; this could be a PAN card, driving license, Voter ID card, Aadhar Card, or Passport. |

| Signature | Signature verification from the bank, Passport, Driving License, and PAN Card (all IDs should match with your current signature) |

| Relationship Proof | Passport, Pan, Aadhaar card, Marriage certificate, Birth certificate, Legal heir certificate, Ration card or any other acceptable documents |

| Document Type | Applicant | Co-applicant |

| Academic Documents | 10th, 12th, UG or PG mark sheets degree or provisional degree certificate and applicable entrance test scores | Registration certificates for Professionals (CA, Doctor) |

| Income proof salaried | Documents to establish 3 years of work experience where ever applicable and available | Latest 3 salary slips, Bank Statement for last 3 months, Form 16, Self-employed: 2 years ITR with the statement of income, Income certificate from Tehsil/collector’s office |

| Bank Statements | Last six months’ bank statements | NA |

| Office Address | NA | Form 16/ Salary slip/ Letter from HR/ Snapshot of site/Identity card |

| Admission Proof | Invite/admission letter from University/college and Fee structure | NA |

In addition to the above-mentioned documents, you must have the following other technical & legal documents to obtain an education loan for abroad studies:

| Technical Documents | Legal Documents |

| Title deed (all the pages to be attached) | Sale/gift/partition deed in favor of customer Minimum 13 years |

| Copy of approved layout plan and permissions case specific | Khata Certificate and extract in the name of the current owner |

| Revenue document (Khata I Patta) | Encumbrance certificate – Minimum 13 years reflecting all sale transactions |

| Development Authority Allotment – NOC and allotment letter | A latest property tax receipt |

| Non-Encumbrance certificate | NOTE: These requirements can vary as per the financial institution’s norms. |

| Possession Certificate (In case the flat is taken from a builder) | |

| A latest Property tax receipt | |

| Copy of Prior sale deeds | |

| Conversion certificate | |

| Urban clearance certificate (Case-specific) |

Procedure for getting a student loan for studying abroad

- Firstly, you need to check the course you want to apply for – is recognized by the financial institution/bank or not.

- Check the amount of loan you will be needing to study abroad and how much you can arrange on your own.

- Compare the education loans offered by different banks to study abroad and find one that best suits your needs.

- After finalizing the bank and loan amount, complete the loan application form and go to your bank.

- Once your loan gets approved, the bank will issue a loan document covering various aspects of the loan.

- After signing the loan document, the bank will issue the loan in installments or as per the request of the university.

How to get a student loan for abroad studies without collateral?

Education loans have been a great help to those who want to pursue higher education and who are facing major challenges in budgeting. Students can now borrow up to INR 4 lacs without collateral. For getting education loans, up to Rs 7.5 lacs, parents or guardians are made joint borrowers and a third-party guarantee is obtained. For loans above INR 7.5 lacs, a collateral loan is provided.

Top Indian banks offering student loans for studying abroad

Top Non-financial Companies (NBFC) offering education loan

- HDFC Credila

- International Student Loan Program (ISLP)

- Avanse Financial Services

- Global Student Loan Corporation (GSLC)

Epilogue

Studying abroad can be a big decision. Those who want to study abroad, but finding it difficult to budget, have the option of obtaining a loan to study abroad or in India. This post gives all the information, including the eligibility criteria, the required documents, and the loan procedure for Indian students who plan to study abroad.

If you still have some, why not ask professional experts? Talk to our industry experts and know yourself in and out! iDreamCareer is on a mission to reach every state and every child to ensure that talent is appropriately delivered into the industry. We try to help young confused minds from 9th class, 10th class, class 11, class 12 with an aim to select their most-suited career choices.

Useful Links:

- Best Countries to Study Abroad: What You Need to Know

- Exams to Study Abroad

- Top Medical Colleges in Georgia

- Steps to Study Abroad

- Scholarships to Study Abroad for Indian Students

- Cheapest Country to Study Abroad for Indian Students

- How to get scholarship to study abroad?

- Study Abroad Consultants: Where to find them?

- Study Abroad: All you need to know

- How to Study Abroad

Also Read:

Scholarships for Indian Students in Canada

AFCAT Exam Pattern

Bank Job After 12th?

Career in Finance

Know Everything About Banking Courses

DASA: Eligibility Criteria, Application process

FAQs

Education loans have been a great help to those who want to pursue higher education and who are facing major challenges in budgeting. Check your loan eligibility online, get advice from a loan expert to compare available options, choose a lender and apply online, get an education loan document checklist, submit the required education loan documents online or get the documents from your home representative, get property and another legal appraisal (in secured loans), get loan sanction letter after approval of education loan from a lender.

Yes, using a study abroad loan is the best choice for you. Not only will it help you achieve your dreams, but it will also save you money. Under Section 80E of the Income Tax Act, students can claim a tax deduction for up to 8 years on their student loan interest payments.

Following are some of the banks that offer the best foreign education loan in India: Axis Bank, Bank of Baroda, Canara Bank, Federal Bank, HDFC Bank, State Bank of India (SBI), Punjab National Bank, etc.

First and foremost, it is important to assess whether you are eligible to apply for an education loan or not. Please note that individual banks may have their eligibility guidelines to be followed when applying to that bank.

Anushree Rastogi is a Senior Content Writer at iDreamCareer, bringing over 5 years of expertise to the field of career counseling. She has done a PGDM in Marketing and Finance and possesses a unique blend of skills that allows her to craft engaging and informative content. She is passionate about helping individuals navigate their career paths and has dedicated her career to providing valuable insights through her content. Her commitment to excellence and keen understanding of the career landscape make her a trusted guide for those seeking professional direction. With a flair for clear and engaging writing, Anushree is on a mission to empower others to make informed and fulfilling career choices.